Navigating the Labyrinth of Leverage: A Comparative Analysis of Isolated and Cross Margin Trading in Cryptocurrency Markets

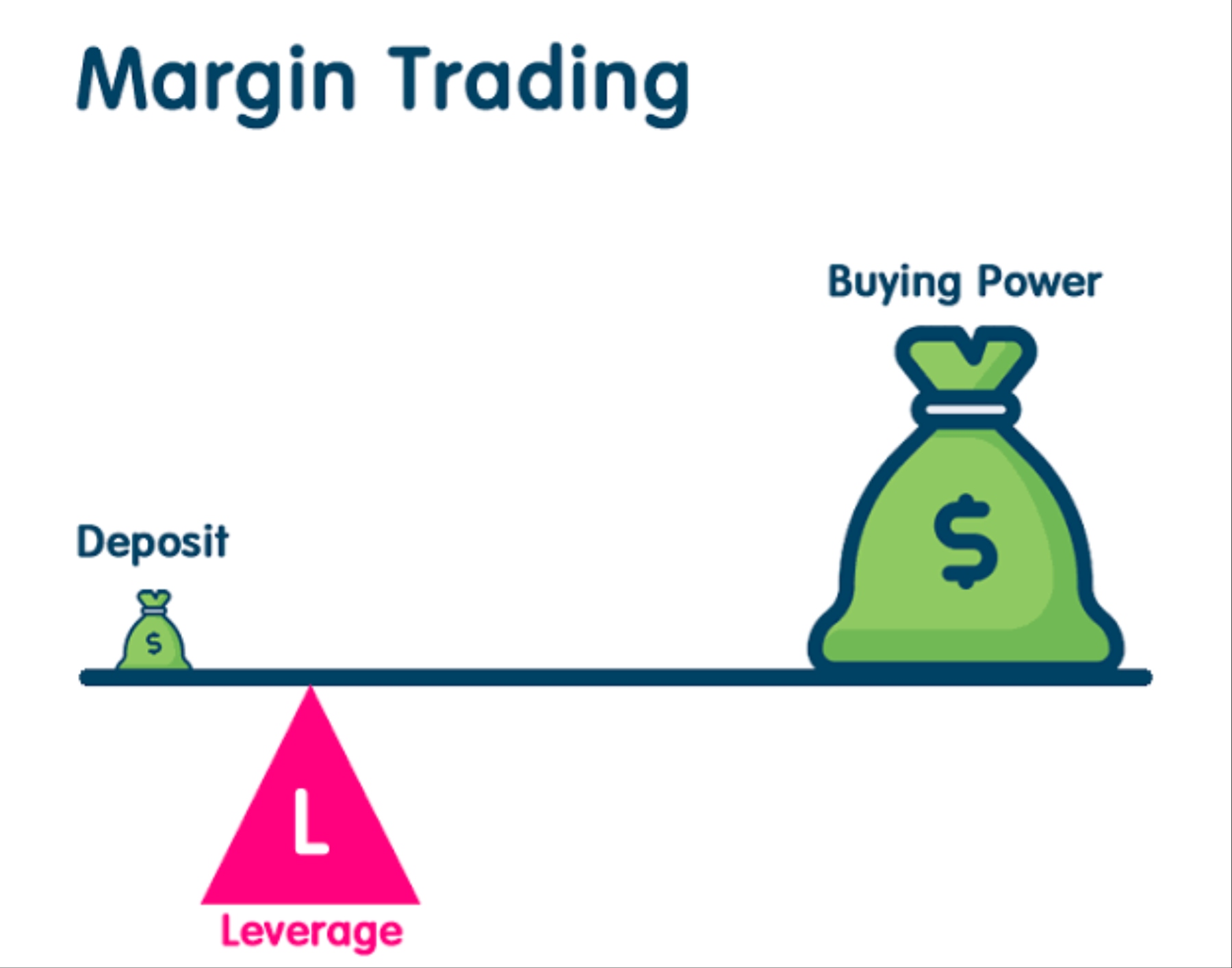

In the dynamic realm of cryptocurrency markets, margin trading has emerged as a pivotal strategy for investors seeking enhanced profitability. Unlike traditional trading, margin trading allows individuals to borrow funds, amplifying their buying power and potentially magnifying returns. However, the allure of increased gains comes hand in hand with heightened risks, necessitating a profound understanding of the intricacies involved. One of the critical facets influencing the outcome of margin trading endeavors is the judicious selection of the margin type, an elemental decision that holds profound implications for risk management and overall portfolio stability.

Importance of Choosing the Right Margin Type

The paramount importance of choosing the right margin type cannot be overstated, as it constitutes the bedrock upon which an investor's risk exposure is constructed. A meticulous evaluation of one's risk appetite, market conditions, and financial objectives should guide this decision-making process. The repercussions of an uninformed choice can be severe, potentially exposing traders to unforeseen volatility and precipitating substantial financial losses.

Two Main Types of Margin Trading: Isolated and Cross Margin

Isolated Margin

Isolated margin trading, an archetype of risk containment, involves segregating each position, allowing traders to allocate a predetermined amount of their capital to a specific trade. This delineation ensures that losses in one position do not spill over into others, providing a structured approach to risk mitigation. While this method instills a sense of control and predictability, it requires a meticulous assessment of individual trade requirements, demanding a granular understanding of asset behavior and market dynamics.

Cross Margin

Conversely, cross margin trading adopts a more holistic approach, leveraging the entire available capital to support all open positions. This type of margin trading is emblematic of a comprehensive risk-sharing mechanism, wherein gains from one trade may offset losses in another. While this approach minimizes the need for constant reassessment of position sizes, it exposes the trader to a higher degree of risk, potentially magnifying losses across the entire portfolio in the event of adverse market movements.

Isolated Margin

Isolated margin trading is a risk management strategy in cryptocurrency markets where collateral is distinctly assigned to individual positions, creating a segregated framework for each trade. The key feature lies in the meticulous allocation of funds, allowing traders to confine the impact of market fluctuations to specific positions without affecting the entirety of their capital.

In this method, collateral is strategically earmarked for each open position, ensuring that the potential losses associated with one trade do not encroach upon the capital allocated to other positions. This precision in collateral allocation forms the foundation of risk isolation, providing traders with a robust mechanism to shield their overall portfolio from the adverse consequences of an individual trade turning unfavorable.

The primary advantage of isolated margin trading lies in its ability to offer precise control over risk for each trade. By isolating collateral for individual positions, traders can implement nuanced risk management strategies tailored to the specific characteristics of each asset. This not only facilitates the execution of sophisticated hedging strategies but also accommodates diversified portfolios, allowing investors to spread risk across various assets without undue interdependence.

Illustration with a Basic Example Using Leverage

For instance, consider a trader with a total capital of $10,000 engaging in isolated margin trading with a leverage of 5:1. In this scenario, the trader can open a position worth $50,000 using $10,000 of their own capital and borrowing an additional $40,000. If this particular trade incurs a loss, the impact is confined to the allocated $50,000, and losses from this position do not affect the capital assigned to other trades.

Advantages

- Precise Control over Risk for Each Trade: Isolated margin trading allows traders to fine-tune risk exposure for individual positions, enabling a meticulous approach to risk management.

- Suitable for Hedging Strategies and Diversified Portfolios: The method is well-suited for implementing hedging strategies and managing diversified portfolios, as it permits independent risk assessment for each asset.

- Reduced Chance of Total Account Liquidation due to One Losing Position: Since losses are contained within specific positions, the risk of total account liquidation stemming from a single losing position is significantly mitigated.

Disadvantages

- Requires More Active Management of Individual Margin Levels: Traders employing isolated margin must engage in more active monitoring and management of individual margin levels for each position, demanding a heightened level of attention.

- May Not Be Optimal for Maximizing Leverage Across the Entire Account: While precise, isolated margin trading may not be the optimal choice for those seeking to maximize leverage across their entire account, as it constrains the deployment of leverage to specific positions.

- Potential for Isolated Margin Calls on Losing Positions: There exists the risk of isolated margin calls on losing positions, necessitating prompt and strategic responses to prevent liquidation.

Cross Margin

Cross margin trading is a risk management approach in cryptocurrency markets wherein all account assets are consolidated and utilized as collateral for all open positions. Unlike isolated margin trading, this method allows for a more comprehensive utilization of available capital, pooling resources to cover the collective exposure of all active trades. The key feature lies in the interconnected nature of collateral, where gains and losses from one position can affect the available margin for other trades.

In cross margin trading, the entirety of the account balance serves as collateral for all positions, offering a holistic approach to risk management. This interconnectedness, however, introduces a potential for cascading losses, as the gains or losses from one position impact the overall margin available for other trades.

The interconnected nature of cross margin trading implies that losses in one position can affect the margin available for the entire account. This can lead to a cascade effect, where losses in one trade trigger margin calls, potentially impacting the viability of other positions. The increased potential for cascading losses underscores the importance of vigilant risk monitoring and strategic position management in cross margin trading.

Illustration with a Basic Example Using Leverage

For instance, consider a trader with a total account balance of $10,000 engaging in cross margin trading with a leverage of 5:1. In this scenario, the trader can open positions worth a cumulative value of $50,000, utilizing the entire account balance and borrowing an additional $40,000. While this allows for larger positions and potential profits, it also means that losses in any one trade can impact the entire account's available margin.

Advantages

- Simplified Risk Management with Automatic Collateral Adjustments: Cross margin trading simplifies risk management by automatically adjusting collateral across all positions, eliminating the need for precise allocation to individual trades.

- Potentially Allows for Larger Positions and Higher Profits Across the Account: The interconnected nature of collateral in cross margin trading can potentially enable traders to take larger positions and pursue higher profits across the entirety of their account.

- Can Benefit from Profitable Positions Offsetting Losses in Others: Gains from profitable positions have the potential to offset losses in other trades, offering a risk-mitigating mechanism.

Disadvantages

- Increased Risk of Total Account Liquidation Due to Interconnected Positions: The interconnected nature of collateral heightens the risk of total account liquidation if a series of losing positions deplete the available margin.

- Less Control Over Individual Position Risk and Diversification: Traders have less control over the risk exposure of individual positions and may find it challenging to implement diversified strategies effectively.

- Requires Careful Position Sizing and Monitoring to Avoid Excessive Leverage: Given the potential for cascading losses, prudent position sizing and vigilant monitoring are essential to prevent excessive leverage and mitigate the risk of total account liquidation.

Choosing the Right Margin Type

Selecting the appropriate margin type is a critical decision that hinges on a nuanced consideration of several factors, each integral to an investor's unique circumstances and strategic goals.

1. Trading Experience and Risk Tolerance

● Novice traders or those with lower risk tolerance may find isolated margin trading more suitable, as it provides granular control over individual positions.

● Experienced traders with a higher risk appetite might lean towards cross margin trading for a more comprehensive utilization of available capital.

2. Trading Strategy and Portfolio Diversification

● Isolated margin trading is conducive to implementing specific strategies and managing diversified portfolios with independent risk assessments for each asset.

● Cross margin trading, with its interconnected collateral, may be preferable for those seeking a more unified approach to risk across their entire portfolio.

3. Expected Market Volatility and Potential for Losses

● In the face of anticipated high market volatility, isolated margin trading may offer a protective shield by confining losses to individual positions.

● Cross margin trading, while potentially more profitable, exposes the trader to the risk of cascading losses in volatile markets.

4. Leverage Requirements and Desired Profit Potential

● Traders seeking precise control over leverage for each trade may opt for isolated margin trading, where leverage is applied individually to specific positions.

● Those pursuing larger positions and potentially higher profits across the entire account may be drawn to cross margin trading, leveraging the collective capital for a more expansive trading approach.

Comparison Table: Isolated vs. Cross Margin

|

Criteria |

Isolated Margin |

Cross Margin |

|

Risk Control |

Provides precise control over risk for each trade. |

Offers a more interconnected approach, potentially leading to cascading losses. |

|

Suitability for Diversification |

Suitable for managing diversified portfolios. |

Less effective for nuanced diversification due to interdependence. |

|

Chance of Account Liquidation |

Reduced chance of total account liquidation due to isolated losses. |

Increased risk of total account liquidation if interconnected positions suffer losses. |

|

Management Complexity |

Requires more active management of individual margin levels. |

Simplifies risk management with automatic collateral adjustments. |

|

Optimal Leverage Deployment |

May not be optimal for maximizing leverage across the entire account. |

Potentially allows for larger positions and higher profits across the entire account. |

|

Potential for Profit Offset |

Profit and loss are contained within specific positions. |

Gains in profitable positions can offset losses in other trades. |

The choice between isolated and cross margin trading should be an informed decision, considering one's experience, risk tolerance, trading strategy, and market expectations. Each approach presents distinct advantages and disadvantages, and understanding these nuances is crucial for navigating the complexities of cryptocurrency margin trading successfully.

Advanced Strategies and Use Cases

1. Hedging Strategies with Isolated Margin to Limit Downside Risk

Hedging involves mitigating risk by strategically offsetting potential losses in one position with gains in another. Isolated margin trading provides an ideal framework for implementing hedging strategies due to its precise control over individual positions.

Traders can initiate a hedging position in an asset correlated with their primary investment to act as a buffer against adverse market movements. By allocating a portion of their capital specifically for hedging, they can limit downside risk while maintaining exposure to potential gains in the primary position.

Example

Suppose a trader holds a substantial position in a cryptocurrency but anticipates a short-term market downturn. They can use isolated margin to open a hedging position in a stablecoin or an inversely correlated asset, thereby mitigating potential losses during the market downturn.

2. Arbitrage Opportunities Using Cross Margin with Careful Position Sizing

Arbitrage involves exploiting price differentials for the same asset across different markets. Cross margin trading, with its interconnected collateral, facilitates the simultaneous opening of positions on multiple exchanges to capitalize on these price inefficiencies.

Traders identify price disparities for an asset on different exchanges and execute buy and sell orders to profit from the price differential. Cross margin trading allows for the simultaneous utilization of the entire account balance across various exchanges, maximizing the potential profit from arbitrage opportunities.

Example

A trader observes a price difference for a specific cryptocurrency between two exchanges. By utilizing cross margin, they can simultaneously buy the lower-priced asset on one exchange and sell it at a higher price on another, capitalizing on the price gap for profit.

3. Leveraged Grid Trading Strategies with Risk Management Considerations

Leveraged grid trading involves establishing a grid of buy and sell orders at predetermined price levels. While this strategy can be implemented with both isolated and cross margin, it requires meticulous risk management to navigate market fluctuations successfully.

Traders set a grid of buy and sell orders at predefined intervals above and below the current market price. By utilizing leverage, they can enhance the profit potential. Risk management is crucial, involving careful consideration of position sizes, grid spacing, and leverage levels to avoid excessive exposure.

Example

A trader places buy orders at regular intervals below the current market price and sell orders above. With leverage, they amplify potential profits. However, risk management is essential, adjusting position sizes and grid spacing based on market conditions to mitigate losses in volatile markets.

In employing these advanced strategies, traders should conduct thorough research, continually assess market conditions, and implement rigorous risk management practices. These strategies demand a nuanced understanding of market dynamics and the specific risks associated with each approach, emphasizing the importance of continuous monitoring and adaptation to optimize outcomes in the ever-evolving landscape of cryptocurrency trading.

Conclusion

The choice between isolated and cross margin trading is a pivotal decision that significantly influences an investor's risk exposure and potential returns in the dynamic landscape of cryptocurrency markets. Let's recap the key takeaways of each approach:

Isolated Margin

● Provides precise control over risk for each trade, confining potential losses to specific positions.

● Suitable for hedging strategies and managing diversified portfolios with independent risk assessments for each asset.

● Reduces the chance of total account liquidation due to isolated losses.

● Requires more active management of individual margin levels.

Cross Margin

● Offers a more interconnected approach, potentially allowing for larger positions and higher profits across the entire account.

● Simplifies risk management with automatic collateral adjustments but increases the risk of total account liquidation due to interconnected positions.

● Less suitable for nuanced diversification, as gains and losses in one position can impact the viability of others.

● Requires careful position sizing and monitoring to avoid excessive leverage.

The critical nature of choosing the right margin type cannot be overstated. Whether it's the precision of isolated margin for detailed risk control or the comprehensive approach of cross margin for potential larger profits, the decision should align with individual trading experience, risk tolerance, and strategic goals.

As the cryptocurrency market evolves, traders are urged to delve deeper into the nuances of each margin type and conduct thorough research before making decisions. Practicing effective risk management strategies, regardless of the chosen approach, is paramount to navigate the inherent volatility and uncertainties in the crypto space.

In the pursuit of sustainable success, continuous learning, adaptability, and a commitment to prudent risk management practices will serve as indispensable assets. Engaging in further research, staying informed about market developments, and honing one's trading skills will empower individuals to navigate the intricacies of margin trading successfully. Remember, the path to success in cryptocurrency trading is paved with a combination of knowledge, strategic decision-making, and disciplined risk management.